You can't fool us, you don't want

embedded insurance

You want to sell more insurance

If you want to do more than just compete on price, you may want to read on

Want to know how to sell more with our product? Watch the video

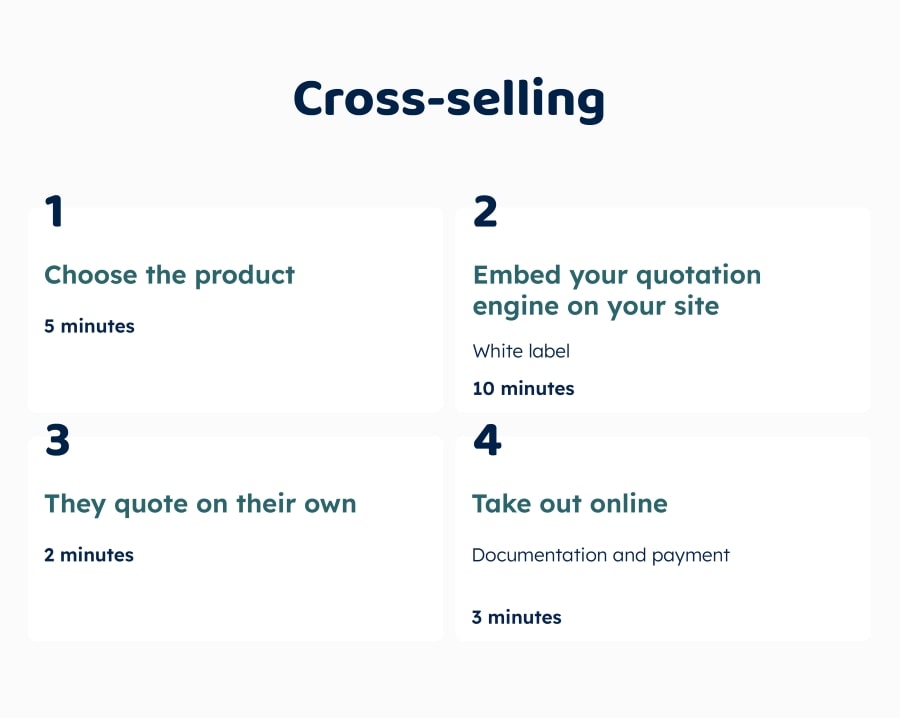

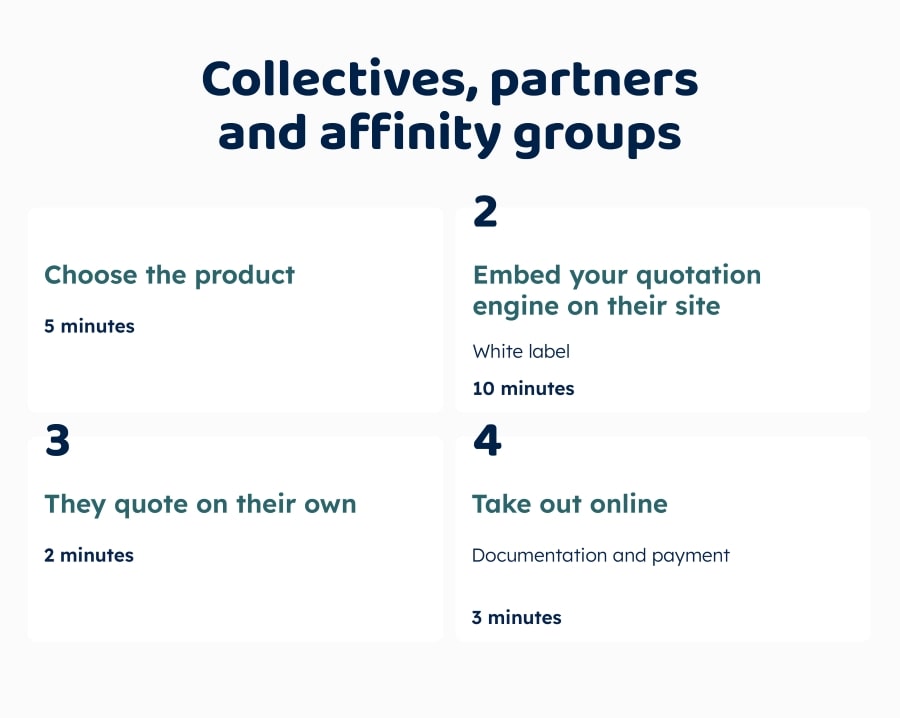

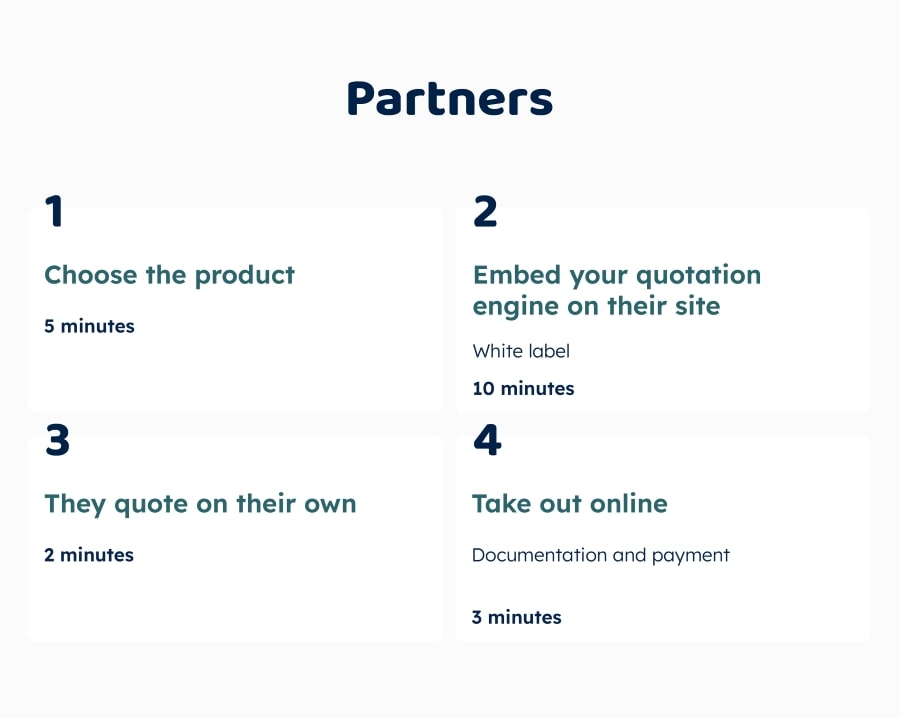

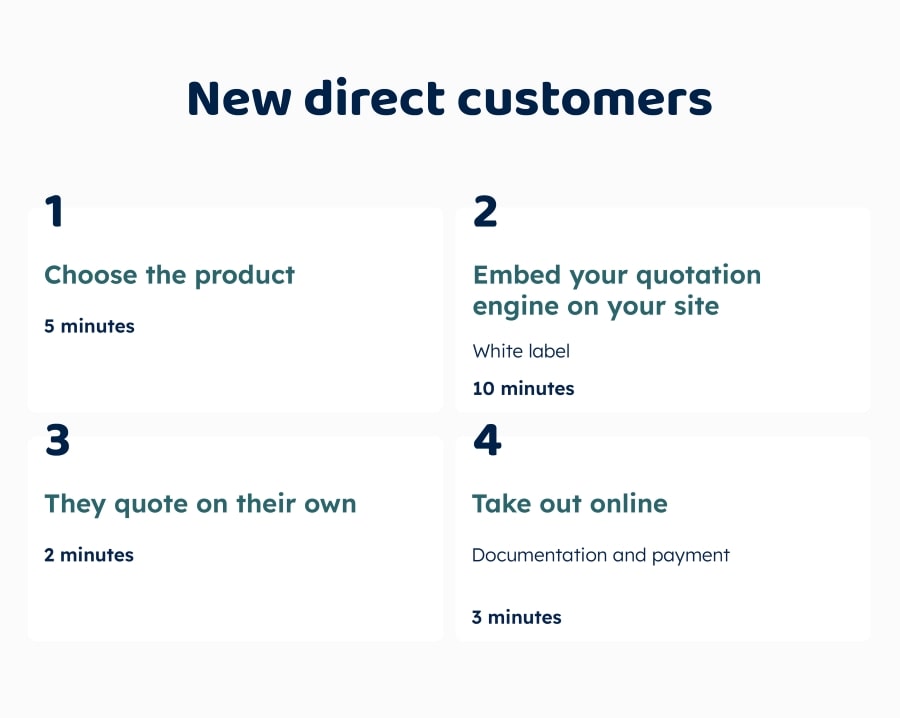

Brokers use our platform to sell more insurance and digitize their sales

We help brokers to sell more insurance through our digital and online sales technology, which allows them to exploit the levers of their commercial development:

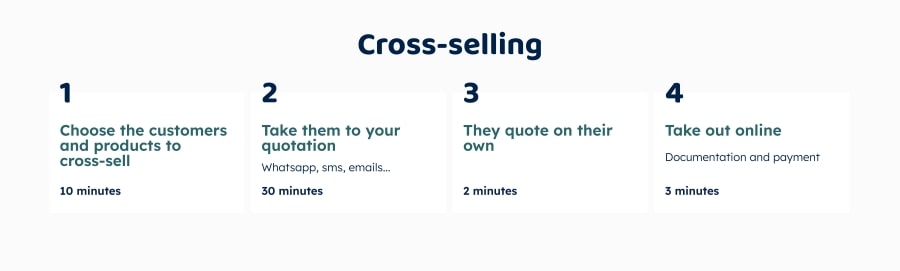

- Portfolio

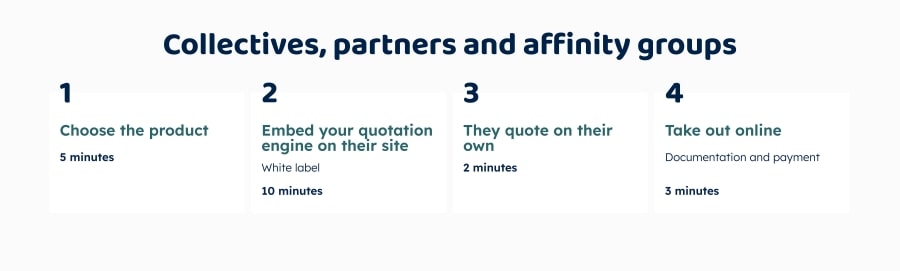

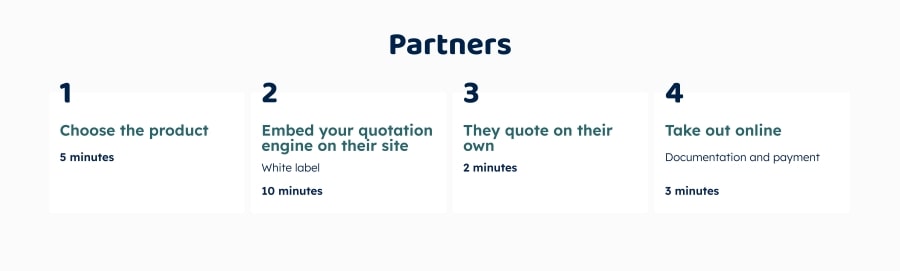

- Partners

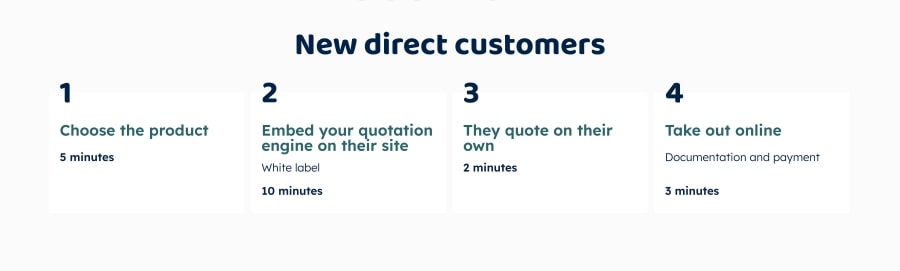

- New direct customers

We know about selling insurance online

We've been doing it since 2010

We were among the first, and it wasn’t auto insurance, but professional and construction liability.

We learned what works and what doesn’t, because, since then, we have spent the equivalent of a Primitiva prize on online advertising and marketing for insurance.

Now we help others sell insurance online using our technology and what we have learned.

What do we offer you?

- Sell more and reach more customers

- Automate commercial processes

- Reduce sales cycles

How will you make it happen?

First month

You will make more contributions than in the last year

Second month

You will make more contributions than in the last 10 years

In less than one year

You will make more contributions than in your entire professional life

Of course, if you do things right and if this is for you.

Someone had to tell you

If you are not launching initiatives that allow you to expand your commercial reach without increasing your costs, if you are not going to do something that is truly differential… You’re not ready for what’s coming.

It’s not that the best opportunities will be in the digital world, it’s that the offline opportunities will eventually disappear. You’d better be ready as soon as possible or you’ll see how some kid with a laptop and a website will take away your clients.

We work for insurance specialists who want to sell more.

Not better, more. Much more.

Everything else doesn’t matter to us, we take it for granted that you know insurance, we know technology to sell insurance 😉.

Don’t get us wrong: it’s not that we don’t care if you’re great at insurance, it’s that we’re here to talk about selling.

Pay attention

More and more technology is being developed for the insurance sector

No, we don’t want to scare you, we want to make you see that one of the biggest opportunities in the industry is within your reach: Technological innovation is geared towards disintermediating and getting brokers, agents and even traditional insurers out of the way.

- Embedded Insurance

- Multichannel Insurance

- Phygital and Hybrid

Do you have exclusive or packed products and want to digitize them?

Now it’s easier and faster than ever.

It’s not Tinder but we have to match

We are not for you if

- You are satisfied with a ratio of 1.3 policies/client

- You believe that your customers do not buy online

- You do not believe that insurance can be sold digitally

- You're not willing to put your guts into it

- You want to get it for free

- You still find your 2003 web site cool

We are for you if

- You want to do more than compete on price

- You want to take advantage of opportunities that were previously overlooked

- You know that automating sales is increasing your profits

- You value an investment by its return, not by what it costs

- You think there is always more money to be made

This is different, this is about selling more

- If you have done nothing so far

- If you already have a website oriented to sell

- If you already have quoters

- You can start progressively and adapt easily

- Choose the level and scope of automation you want to implement

- Start to better exploit your portfolio and start with groups and partners

- You will be able to get more contacts from interested customers

- You will have a platform to offer to your clients (if you want to)

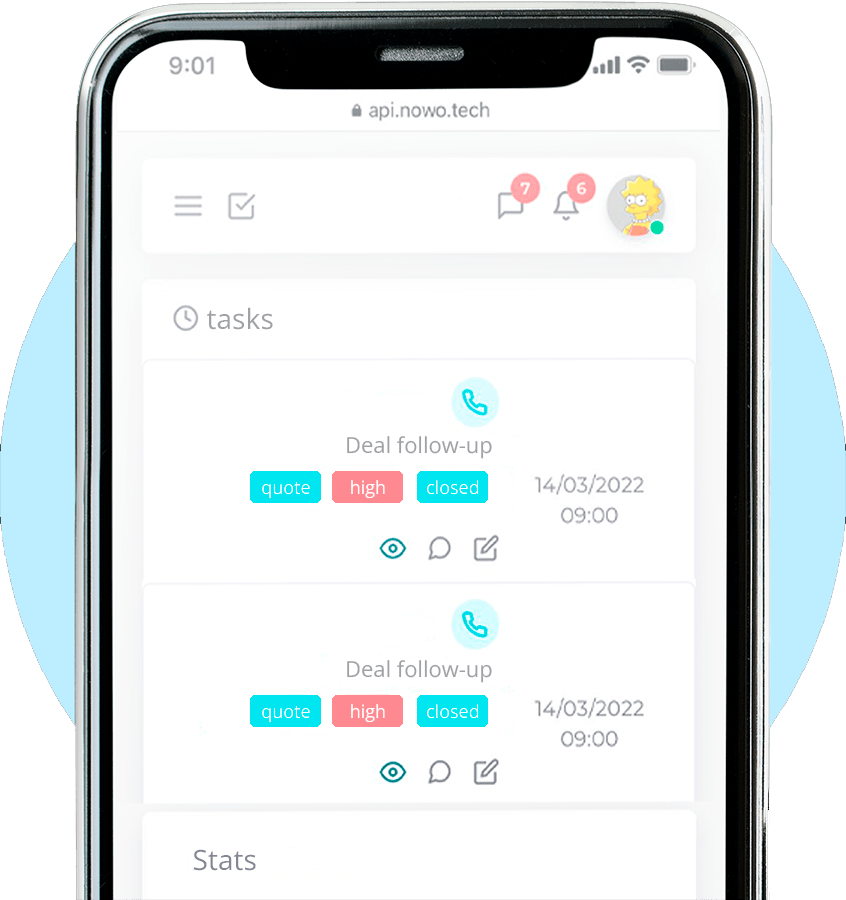

where they will be able to manage their own policies in an autonomous way - You will have a platform for your employees and collaborators where they will be able to consult all the information and history of your clients (renewals, policies issued, average premium…)

- You will be able to digitalize and/or automate the issuing process,

of any product - You will improve your conversion rates and further amortize your advertising investment

- If you have done nothing so far

- If you already have a website oriented to sell

- If you already have quoters

- You can start progressively and adapt easily

- Choose the level and scope of automation you want to implement

- Start to better exploit your portfolio and start with groups and partners

- You will be able to get more contacts from interested customers

- You will have a platform to offer to your clients (if you want to)

where they will be able to manage their own policies in an autonomous way - You will have a platform for your employees and collaborators where they will be able to consult all the information and history of your clients (renewals, policies issued, average premium…)

- You will be able to digitalize and/or automate the issuing process,

of any product - You will improve your conversion rates and further amortize your advertising investment

Contents

What is Embedded Insurance?

In recent years there has been a change in the consumption model, affecting the insurance sector as well.

When we talk about embedded insurance, we are referring to the guarantees or coverage included in the purchase of a product or service, which is part of the customer’s shopping experience.

Some examples where embedded insurance would be useful are:

- When buying airline tickets. The user could decide to contract with one company instead of another when seeing that travel insurance is included at no extra charge.

- When buying a cell phone. During checkout, the user could choose to add mobile insurance as an extra to his purchase. He had decided to purchase insurance, and for convenience he prefers to do it in the same store where he bought his smartphone.

We can say, therefore, that this new insurance distribution model not only manages to scale sales; it also allows businesses to differentiate themselves, build loyalty and increase their customer portfolio. Without the need to allocate too many resources and achieving 100% effective management.

Is embedded insurance suitable for my business?

If you want to sell more insurance and compete on more than just price, the answer is a resounding yes. Our tool is designed for any brokerage to exploit the levers of its commercial development:

- Portfolio

- Partners and groups

- New direct customers

From any digital support, either our own or from collaborators. Website, app, intranet…

Advantages of using embedded insurance

With our automated and embeddable insurance model you will be able to sell more policies with less effort, automating your tasks and offering your clients the possibility of enjoying a 100% online service.

You will take operational advantage, since you will not be subject to the insurance company to give you the information, which will allow you to spend more time selling and less time managing the business.

You offer a unique service to your clients, improving your prestige and recognition in your sector.

Some of its most outstanding advantages:

Offers fully customizable products

Reach a wider audience

Make your sales more profitable

Scale your insurance business faster

Differentiate yourself from competitors

Very affordable price

Why choose Nowo.tech?

Nowo.tech is the insurtech that is revolutionizing the insurance brokerage sector and any business thanks to its proposal of embedded insurance, making simple what until now seemed complex.

With a team of professionals that combines a great experience in the insurance sector, combined knowledge of insurance sales and digital advancement.

We keep updated versions of our tool for you to get the most out of it.

Our digital solutions are adaptable to any company, regardless:

- Sector

- Business size

- Digital level

Discover our features

Our solution offers you numerous functionalities that will allow you to sell more in a more efficient way. No matter the size of your brokerage, level of digitalization or types of insurance you work with, we have what you need.

Insurance sales system

You will have a system for automating and incorporating the platform and its quotation (rate calculator) in any web, app or platform you use. This way, you will be able to sell insurance easily.

Platform for selling insurance

Our platform for selling insurance is a pioneer in the automation and distribution of sales digitally and instantly. In addition to digitizing sales, service, procurement, claims…

Insurance software

There is no insurance software on the market today that offers as many benefits as Nowo.tech and is 100% customizable.

Our features address the needs of end users, brokers and insurers alike.

Saas for insurance

It has never been easier to effectively manage and control your customer relationships. The advantages of automation thanks to our insurance saas provides the scalability of your business.

Program to sell insurance

With our insurance sales program, your team will be relieved of most tasks, reducing onboarding and development time to just a few weeks.

Embedded insurance

Our embedded insurance solutions can be integrated into any website, platform or app. There is no need for technical knowledge, no need to develop any function, no technological development on your part and, thanks to its high level of customization and configuration, no one will notice that it is an external solution.

FAQs

What does embedded mean?

It is a technological solution that is embedded in your website, app or digital platform, whose function is to provide automation and technological development to companies.

Is this system for my business?

Of course. Our technology makes insurance distribution easy and profitable for any company, no matter if your business does not belong to the insurance sector. Thanks to our integration API you will be able to sell policies to your customers without even needing a website or digital platform.

Why should I automate the sale of policies?

It will give you a competitive advantage in this increasingly strong market. Since the benefits of embedded insurance for businesses is that it greatly facilitates the automation of the simplest processes (consultations, claims management, claims, claims, notifications …) which means significant cost savings for companies.

What sets Nowo.tech apart in its embedded insurance?

Experience, dedication and vision are skills with which we bring value to the product we offer as an integrated system to help companies achieve their goals.

We are pioneers in offering a technological solution fully customizable to the business and adaptable to the customers of that company, strengthening lasting relationships with users.