Platform for selling insurance

Close many more B2B2C and Affinity deals

No developments for you and your partnersㅤ

- Deployment of agreements in minutes

- Customised agreements

- Improve conversion rates

Tired of not closing deals because you don't have the technology?

There is a growing number of non-insurance businesses wanting to participate in a market worth more than 6 trillion euros and to leverage their relationship with their customer base and offer them the insurance they need at the right time.

ㅤEmbedded insurance ready to integrateㅤ

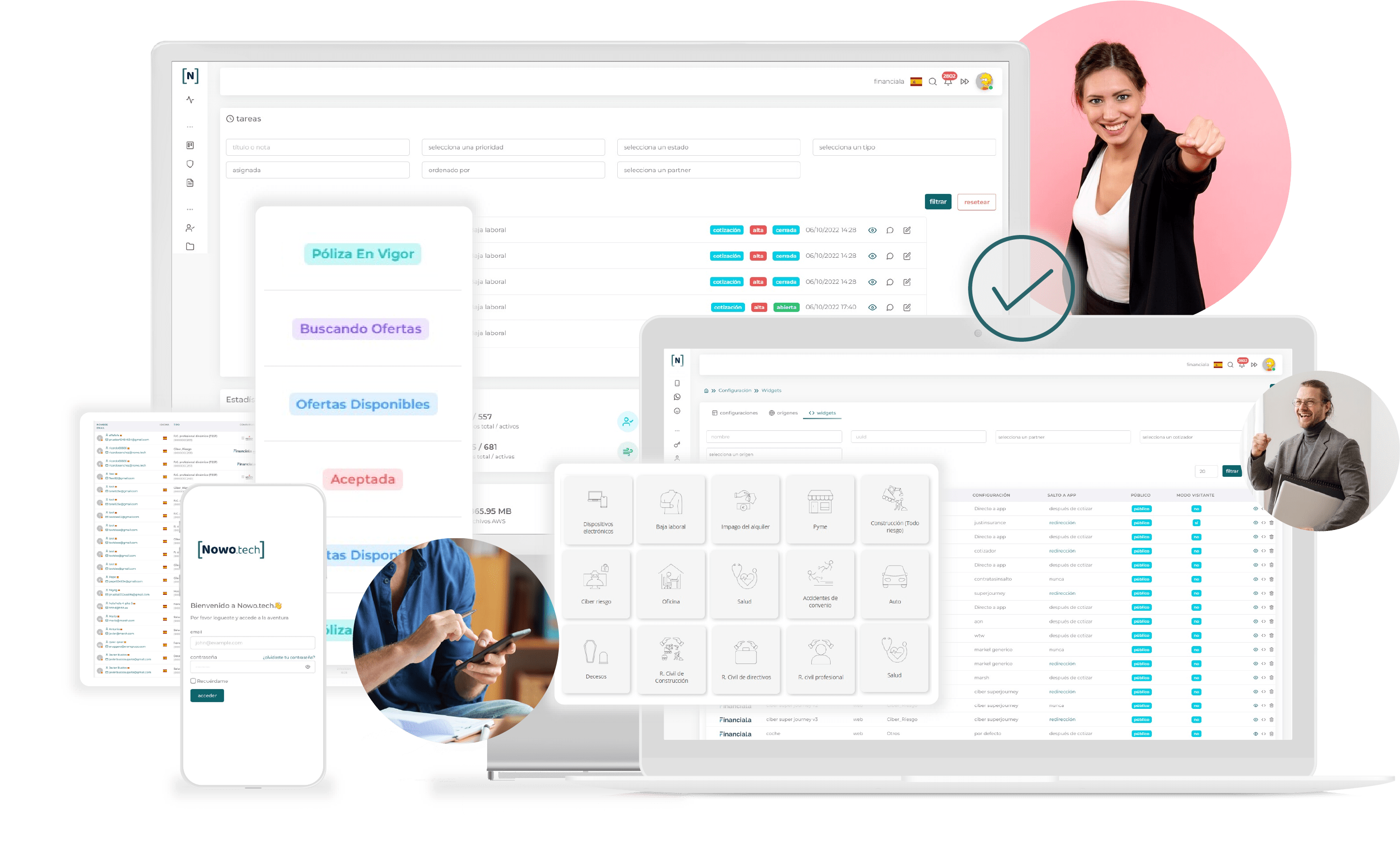

Nowo.tech develops widgets that can be integrated into any website, so that you and your partners can distribute your insurance from any digital medium.

- Quotation

- Recruitment

- Emission and digitised signature

Our no-code, self-service platform means you can embed charging and broadcasting solutions into any web or digital medium

ㅤMultiply your sales, reduce your cost of acquisition and grow your businessㅤ

What does Nowo.tech do?

Advantages of embedded insurance technology

Nowo.tech is the only integrated insurance deployment platform that helps you develop B2B2C/Affinity opportunities without you having to spend digital efforts.

No matter your level of technologyㅤ

- Reach more customers and sell more

- Digitise and automate your business processes

- Reduce acquisition cost and sales cycles

Just by pasting two lines of code you will be able to put your widgets on any digital media instantly.

Play Video

Advanced lead management

Putting at your fingertips all the capabilities to manage leads and campaigns.

Instantaneous self-manageable changes

Customise your widgets and see changes in real time.

Data analysis and monitoring

Check your statistics and improve the conversion rate of your widgets.

100% customisable products and journeys

Configure products and give your partners flows tailored to their customers.

Some of our partners

Embedded insurance ready to integrate

Contents

What is an insurance sales platform?

When we define “what is a platform to sell insurance“, we are talking about technological solutions that do not require installations to enjoy its functions.

It is not only a portal or an application, but an integrable platform to sell insurance digitally B2C or B2BC that allows businesses to digitize the sale of policies giving rise to the automation of tasks, in a simple and fast way.

With this Api, the user works with an online tool, so there is no need for updates and downloads. Applied to the sale of policies, an insurance platform allows to respond to customers in a more efficient way, reducing costs, automating the management of tasks, ordering information … among many other advantages.

As a result, the company has the possibility of increasing its client portfolio without having to allocate so many resources, achieving a 100% effective management.

How does our platform for insurers work?

A tool 100% designed for insurers or brokers, as well as for the end customer.

Our insurance platform gathers all your customer data in one place. Quotes, visits to your quotes, opening emails, upcoming renewals…

This integrable Api offers the opportunity to guide your customers in the interactive quoting of their policy purchase.

One of the most significant functions of the integration of our platform is the scalability of the business in the sale of insurance, as it allows you to automate and digitize all processes completely, freeing up staff time and reducing service costs.

In addition, it has a simple and intuitive interface:

– Easy policy administration

– Intuitive dashboards

– Dashboards, Alerts, Notifications

Why use an insurance sales platform?

With our platform you will be able to sell more policies with less effort, automating your tasks and offering your clients the possibility to enjoy a 100% digital service.

Differentiate yourself from the competition with a platform to sell insurance focused on both your end customers and your employees.

Some of its most outstanding advantages:

More premium growth

Expand your customer portfolio and serve them satisfactorily by reducing efforts, get new sources of acquisition or create a network of collaborators.

Thanks to our platform you will have information at any time of the activity of your customers and their origin, in addition to serve them effortlessly thanks to the automation of tasks.

Better decision making

In our control panel you will have information about your customers and quotes, without allocating resources or time, improving decision making when making sales strategies.

You will only have to dedicate yourself to manual tasks and clients that show more interest in contracting. You will save resources and your efforts will be much more effective.

Build a relationship of trust with your users

Build loyalty to your users by providing a fast and online service. Add value and confidence to your services with the integration of this tool.

Your customers will have instant solutions without losing customization. Quotes, renewal notices, sending emails and Whatsapps...

Offer an exclusive service

Thanks to our platform you will be able to offer your clients an Api where they can administer and manage their policies in a simple and intuitive way.

You will be able to embed the tool in any digital support, such as your website.

An exclusive service through which you will be able to serve customers in a scaled and efficient way, allowing you to increase the revenue and size of your company.

Reduce costs

Thanks to our platform, you won't have to spend so much time attending clients and forcing sales to close. You will be able to focus on other tasks or increase your client portfolio.

Faster digital innovation

Consumer patterns have changed. Offering fast and efficient sales services where the user does not require a lot of effort and time is paramount.

Why not be among the first to use an insurance platform? Your business would position itself as a pioneer in online policy sales.

Why choose Nowo.tech?

Experience, vision and values are skills that define our value in offering our products, in order to provide solutions for companies seeking to scale their profitability by giving them a 360° approach.

A team of specialized professionals to offer you a personalized service, even remotely.

At Nowo.tech we know that the future of technology and innovation in insurance sales begins with integration and automation, that’s why we offer you this platform.

Our digital solutions are 100% adjustable in all businesses, regardless:

- Technological level

- Size and business volume

- Activity type

Discover our features

The alternatives offered by our platform are limitless. Whatever the type or size of your business, Nowo.tech fits the bill and helps you sell policies online quickly and profitably.

Insurance sales system

You will have a system to automate and deploy on the platform and your quotes on the page of your choice, in a quick and easy way with a code.

In this way, you will be able to make insurance sales without the need for external software.

CRM for insurance

We have achieved to be the most detailed and comprehensive CRM for insurance in the market, providing solutions for all levels of innovation, needs and business models.

Program to sell insurance

Our embedded tool is a leader in digitizing all functions and distribution tasks in policy sales. A program to sell insurance that offers: Acquisition, sale, product, service, claims, collection, management, customers, risks…

Saas for insurance

Nowo.tech gives you the possibility to control and manage efficiently the relationships with your clients and intermediaries. All this in an easy and intuitive way, through a Saas for insurance that allows you to set up automatic tasks, administration and management.

Embedded insurance

We offer an embedded insurance system that can be incorporated into any web page, app or digital support. No technological development is required on your part and, thanks to its advanced level of customization and configuration, no one will notice that it is a solution outside your company.

Insurance software

There is no other insurance software on the market today that meets as many needs as Nowo.tech, and that can be adapted to any type of company that exists, regardless of the sector in which it operates. On the other hand, our functions are tailored to meet the needs of end customers, intermediaries and insurers alike.

Frequently Asked Questions

What does embedded insurance mean?

It is the feature that our solutions have to be incorporated into your website, app or any digital support without your customers realizing that it is an external tool and which does not require technological development on your part.

Our integrable Api goes beyond the traditional meaning of embeddable. We digitize and facilitate the sale of any insurance in an optimal and effective way.

Is this platform suitable for my business?

The answer is yes, because our technology offers the possibility for any business or company to sell insurance in a profitable, easy and profitable way.

You will not have to allocate resources or time, therefore you will offer your customers a unique experience providing them with value, which will make your business gain prestige in your industry.

Our API will give instant pricing and make it possible to contract insurance in less than 5 minutes.

Nowo.tech’s solutions are fast and 100% configurable to any business, regardless of the type of business:

– Type of business activity

– Size and volume of business

– Technological level and capacity

Why should I digitize policy sales with Nowo.tech?

The competition works every day to gain authority in the market, which is why implementing technological solutions and gaining the trust of customers is an essential task.

For this, using Nowo.tech’s platform is a smart decision. Thanks to its technology, you will be able to carry out all these functions without losing time or personalized treatment.

Its system allows you to track opportunities, automate activities and send emails and WhatsApp…

Can Nowo.tech replace external insurance software?

Yes, we explain how!

The process starts with the client entering the platform and quoting to know the price of the policy he needs.

Then that data will be recorded and reflected in your administration panel, where you can track and control the type of user involved.

Once that user contracts with our software, you can access his information instantly to check the status of payments, next renewal, among others.

The possibilities do not end here. With our technology you will be able to:

– Know the registration history (if they accessed your website organically, through a google ads campaign, in social networks, poor email…).

– Automate notifications when the renewal is close to completion

– Configure email templates and WhatsApp or Telegram messages.

– Change the stage of the sales cycle you are in.

– Check the productivity of your employees.