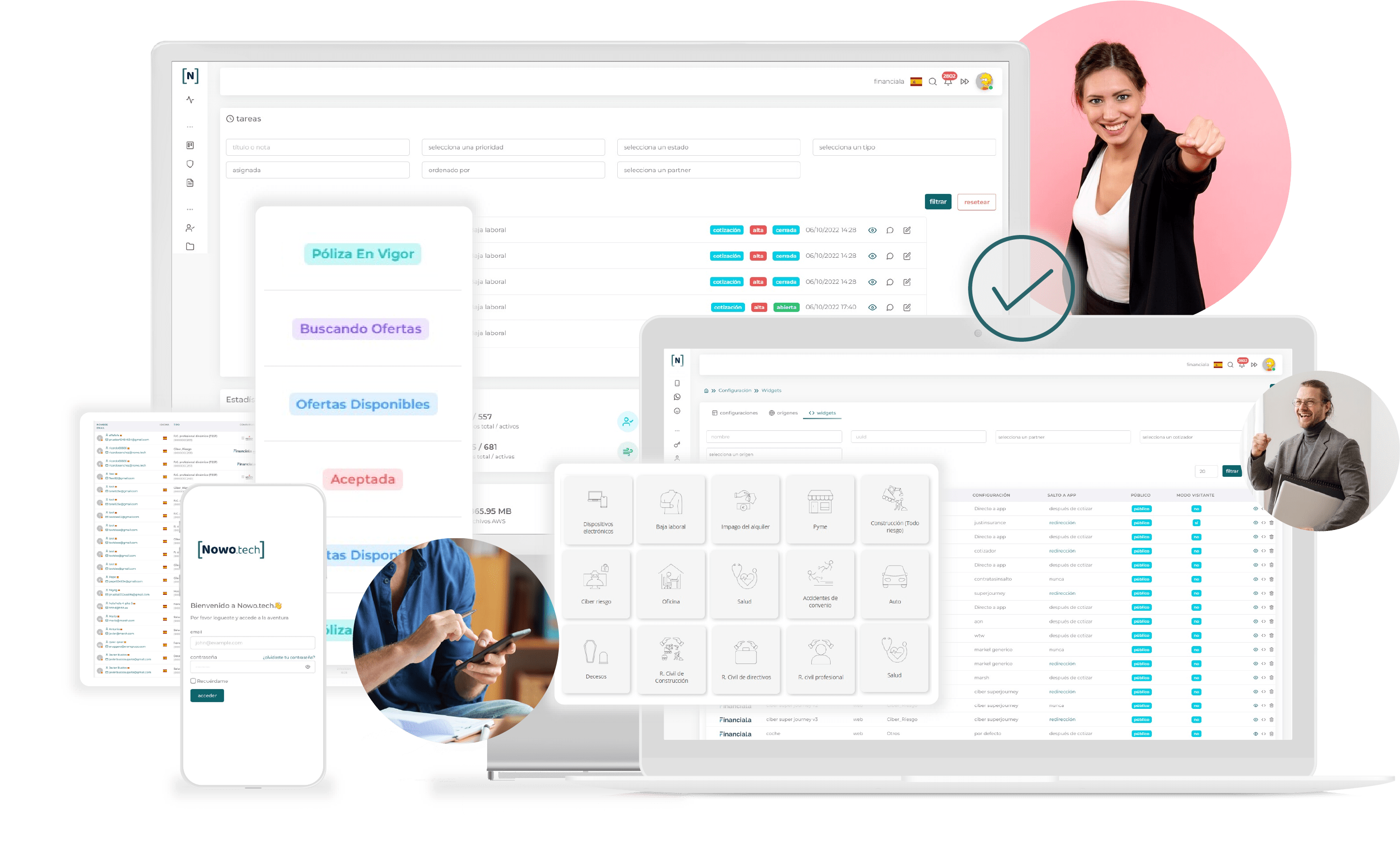

Insurance software

That help to close more B2B2C and Affinity deals

Without you and your partners having to develop anythingㅤ

- Deploy agreements in minutes

- 100% customisable agreements

- Better conversion rates

Stop losing deals because you don't have technology

More and more brands, even if they are non-insurers, want to tap into a market worth more than 6 trillion euros by leveraging their relationship with their customer base and offering them the insurance they need at the right time.

ㅤPlug&Sale Embedded Insuranceㅤ

No matter from where. We develop 100% embeddable widgets so you can distribute your products from any digital environment.

- Pricing engine

- Recruitment engine

- Digital signature and online issuance

Our no-code, self-managing technology means you can embed quoting and issuing solutions into any website

ㅤYou will multiply sales, reduce cost of acquisition and scale your businessㅤ

Why Nowo.tech?

Advantages of our contextual and embedded insurances

We are the only embedded insurance deployment alternative that helps develop B2B2C/Affinity opportunities without digital effort.

We don’t care what level of technology you have

- Reach more customers and sell more

- Automate business processes

- Reduces selling times and acquisition costs

Just paste two lines of code and integrate your widgets instantly.

Play Video

Advanced contact management

Thanks to the capabilities that allow you to monitor your leads and campaigns.

Self-managed real-time changes

Customise the widgets on your own and instantly view the changes.

Data monitoring and analysis

Check your graphics and improve the conversion rate of your widgets.

Journeys and 100% customised products

It offers experiences tailored to each partner by configuring products and their flows in a particular way.

Some of our partners

Embedded insurance ready for integration

Contents

What is insurance software?

Insurance software has traditionally been defined as a technological solution capable of digitalising daily tasks such as customer management, policies, receipts, claims, etc., facilitating the general management and distribution of the insurance sector.

We are not insurance software, nor do we pretend to be, because we are much better at it.

Features

Why should you trust Nowo.tech?

We are much more than an online insurance sales software.

Our solution is focused on the experience of both your end customers and your employees, without forgetting the partners and networks of collaborators that operate with you (ecommerces, service websites…).

In addition, we have made it possible for any of your sales processes to be carried out automatically if you wish, making it possible to scale insurance distribution.

Useful for all

Your customers can calculate prices, consult the insurance policies available to them, check the status of their policies...; Your employees/collaborators have a control panel that speeds up and automates their daily sales tasks.

Brokerages and insurance companies

We don't care about the size, level of digitisation and budget of your company. Our development is designed for everyone.

End-to-end digitisation

We digitise all or part of the sales process. Your customers could quote, recalculate, formalise the contract, fill in questionnaires and send documentation, add payment methods... Autonomously, without having to wait for calls or sending documentation and rates.

No development

Have you thought about how much such a development would cost? You probably couldn't afford it.

At Nowo.tech we have set out to make technology available to all companies in the sector.

Embedded insurance

You will have your own price calculators and insurance quotes 100% integrable in your website. Nobody will notice that it is an external software because we will keep your visual identity.

You will be able to choose where to embed Nowo.tech

Maximum personalisation

No one will know that it is an external tool. It will be under your domain, with your rates, corporate colours, logo, fonts...

Omni-channel communication

Thanks to our omni-channel communication system you will be able to interact with your customers through emails, calls, chats and WhatsApp; but keeping the complete control and history gathered in this software.

The customer in the spotlight

If you wish, you can give your customers access to a platform where they can manage their insurance, quotes, documentation, contracts, payment methods, claims... A self-service channel that not only reduces service costs, but also helps to build customer loyalty.

Ultra-fast start-up

Thanks to our configuration, you will be able to set up and embed Nowo.tech in a matter of minutes. You will be able to customise the colours, fonts, logos, content of the automatic emails...

Adaptability

We really adapt to the needs of your business and your customers. You will be able to choose at which point of the sale to embed Nowo.tech and in which way, which tasks you want us to automate...

No friction

Our platform is very intuitive. Anyone who uses it will know how to use it. In addition, anyone will have access to a user manual with answers to frequently asked questions.

What do we offer you?

A valid platform for any business that wants to sell insurance in a profitable and easy way.

Your employees and collaborators will be able to work efficiently and your customers will have the insurance they want when they really need it, without depending on schedules or third parties. You will give them the option of being totally autonomous in the management of their insurance.

Our solutions are fast and 100% adaptable, regardless:

- Type of activity

- Size and turnover

- Technological level

Advantages of using insurance software

Although there are many benefits that Nowo.tech offers you and each company will give more importance to some or others, these are the most relevant for most of them:

You will be able to scale up insurance sales

You won’t believe how many hours of work you will save thanks to our automations.

You will be able to increase your client portfolio without being overloaded with work.

You will enjoy more profitable sales

Thanks to all these resources and time you will no longer have to spend on customer service, claims management, sending documentation… The cost of your operations will be considerably reduced.

You will adapt to market requirements

Digitalisation is advancing by leaps and bounds in all sectors, and both your employees and your customers expect the same from insurance. They want to have all the information they need at their fingertips instantly and to do business online whenever and wherever they want.

In the case of the insurance market, even with more than 6 trillion euros in turnover, the digital trend has only just begun. You could be one of the first and enjoy a much higher growth margin than you would have in a few years’ time.

Strengthen your brand image

How many companies do you know that already have a 100% technological solution? You will provide your end customers, employees and even networks of collaborators with a digital tool that is really useful and easy to use.

You will be able to integrate it with the tools you already work with

Thanks to our API you will be able to synchronise your data with any application, all we need is your API!

- Docusign

- Hubspot

- Zoho

Discover our functionalities

Whatever functionality you are looking for, Nowo.tech fits all of them. We are much more than:

Insurance sales system

We have created an automated and embedded system with which you will be able to sell insurance effortlessly. No matter your size or technological profile, our insurance sales system adapts to all cases.

Platform for selling insurance

We are the first platform for selling insurance that has managed to digitise all insurance sales and distribution processes from start to finish. From acquisition to sale, including other post-sales processes such as claims management, updating information, collection queries…

Insurance software

We replace any insurance technology tool that exists on the market to date. Our functionalities satisfy both the end customer and the intermediaries and insurers. Marketing tools, synchronisation with any platform, embedded quotation systems, tracking pixels…

CRM for insurance

Our CRM for insurance will allow you to manage your relationships with your customers and intermediaries easily through tasks and alerts.

Software for selling insurance

We have become the most complete solution in the market, offering a programme to sell insurance with options adapted to all levels and needs.

Frequently asked questions

What does embedded mean?

Our solutions can be integrated into your website, app or any digital support without your customers noticing that it is an external tool that does not require any technological development on your part.

Our technology goes beyond the traditional meaning of integration. We digitise and streamline the sale of any insurance to sell insurance.

Is it for my business?

Absolutely yes. Our technology allows any business to sell insurance profitably and easily. You won’t have to commit resources and you’ll offer your customers what they really need at the most relevant time.

Our API will give instant pricing and make it possible to take out a policy in less than 5 minutes.

Nowo.tech’s solutions are fast and 100% customisable for any business, no matter what:

- Type of business activity

- Size and volume of business

- Technological level

Our technology goes beyond the traditional integrable meaning. We digitise and streamline the sale of any insurance to sell insurance.

Why should I digitise policy sales?

Competition in this sector is tough and gaining the trust of customers can be a difficult task. In this situation, actions such as providing them with the best experience in terms of agility, ease of communication, complaint resolution… are very effective.

For this task, using Nowo.tech’s platform is the best decision. Thanks to its technology, all these tasks can be carried out without losing time or personalised treatment.

Its system allows potential clients to follow up on opportunities, automate activities and send emails and WhatsApp…

How does Nowo.tech replace insurance software?

The process will start with the customer quoting the price of the policy they need.

The data will be recorded and reflected in your administration panel, where you will be able to track and qualify the type of user you are dealing with.

Once you contract with us, we can access your information at any time to check the status of payments, next renewal, among others.

The possibilities do not end here. With our development you will be able to:

– Know the origin of the registration (if they accessed your website organically, through a campaign on social networks, thanks to a mailing…).

– Automate notifications when the renewal is close to completion.

– Customise email and WhatsApp message templates

– Change the stage of the sales cycle you are in

– Check the productivity of your employees

What should good insurance software have?

– Registration of new business opportunities

– Customer information assigned to the business opportunity

– History of the user’s evolution in the sales cycle

– Task management

– Block to add customer notes

– Segmentation

– Claims management

– Live chats