Insurance CRM

And to get more B2P2C and Affinity agreements.

You will not have to develop anything, neither you nor your partnersㅤ

- Agreements that unfold in minutes

- Customisable flows for everyone

- Unbeatable conversion rates

Stop losing deals because you don't have technology

You may already know: more and more companies that are not insurers but want to enter this 6 trillion euro market because they already have a customer base and know what insurance they need at the right time.

ㅤEmbedded insurance ready to integrateㅤ

Nowo.tech develops Plug&Sale widgets to add to any website, allowing you to sell your products from any digital environment.

- Instant pricing

- Online recruitment

- Digital issuance and signature

Our self-service and low-code solution allows you to embed quoting and issuing solutions in any web or digital media.

ㅤGrow your sales, reduce your cost of acquisition and boost your businessㅤ

So why Nowo.tech?

Advantages of our embedded and contextual insurances

We are the only embedded insurance deployment tool that allows you to develop B2B2C/Affinity opportunities without digital effort.

No matter what level of technology you haveㅤ

- Sell more and reach many more customers

- Digitise and automate business processes

- Accelerate sales cycles

Paste just two lines of code and embed your widgets instantly.

Play Video

Advanced contact management

With all the capabilities to manage your leads and campaigns.

Real-time, self-manageable changes

Configure your widgets on your own and see the changes instantly.

Data and monitoring

Check your statistics and improve the conversion rates of your quoters.

100% customisable products and journeys

Tailor products and flows and offer personalised experiences for each partner.

Some of our partnerships

Embedded insurance you can integrate now

Contents

What is an insurance CRM?

A CRM, or as its definition indicates (Customer Relationship Management), is the technology responsible for managing and tracking communications between customers and the company, streamlining the processes and tasks needed to convert an end customer into a sale and, subsequently, into a loyal customer.

We can say that a CRM for insurance is essential for those who want to improve the profitability of the business, in addition to detecting which users show more interest based on their behavior.

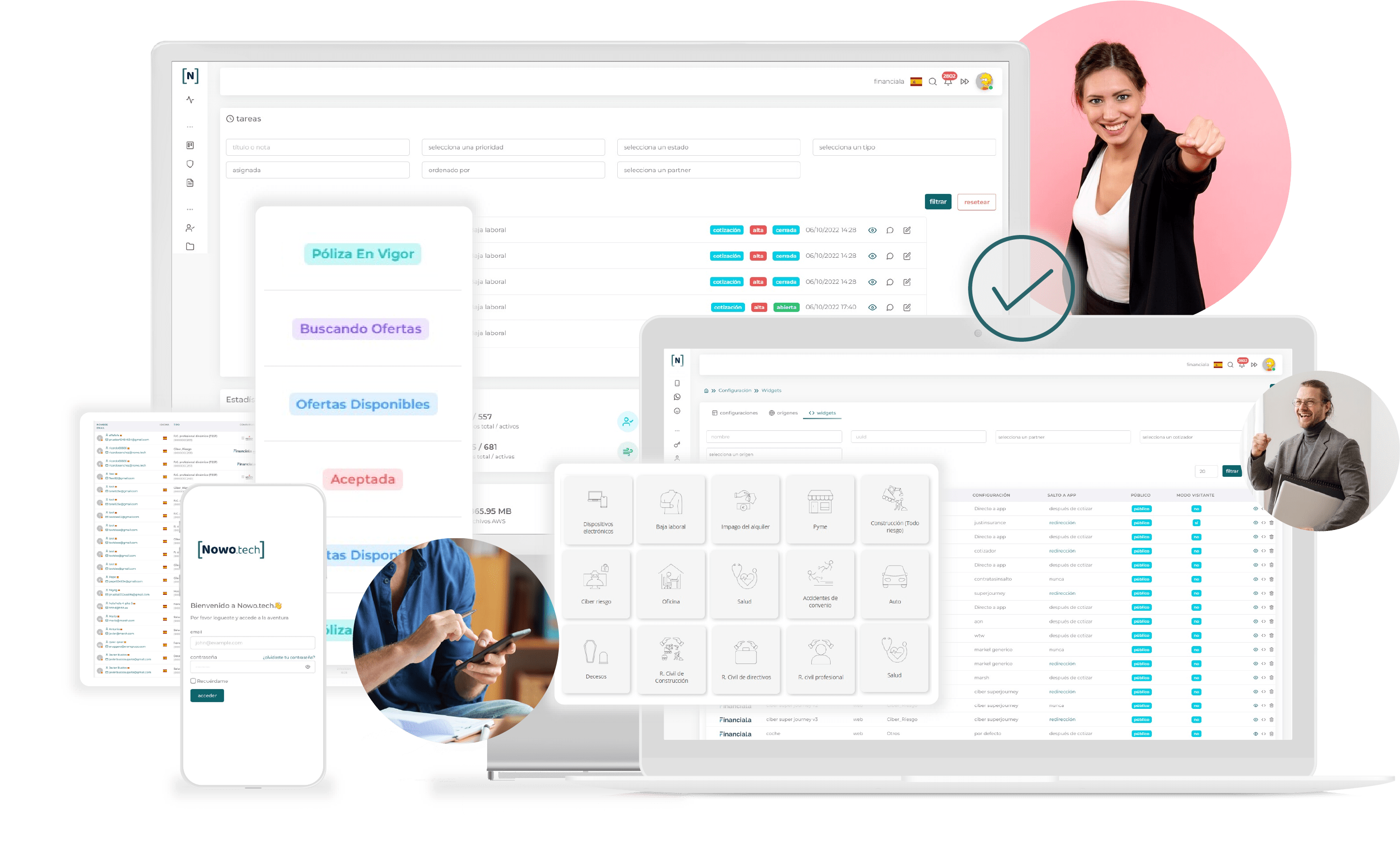

How does our CRM work?

Our CRM for insurance gathers all your customer information in one place. Quotes, visits to your quotes, opening emails, upcoming renewals…

In addition, it will help you reduce time thanks to its automation system. Quotation calculations, sending emails, online payments…

You will be able to digitize your business to the maximum

Advantages of using a CRM for insurance

With our CRM you will be able to sell more with less effort, automating your tasks and giving your customers the possibility to enjoy a 100% digital service.

Differentiate yourself from your competitors with an insurance CRM focused on both your end customers and your employees.

Some of its most outstanding advantages:

Higher revenues

Our platform is 100% integrable in any part of your website, app or other digital support. You can customize the colors, fonts... giving it the same aesthetics as the rest.

Your customers will not notice that it is an external tool and you will not need any extra development.

You will be able to sell personalized insurance where and when the customer really needs it.

Better customer service

You will be able to provide a fast and online service. Your clients will have instant solutions without losing personalization. Quotations, renewal notices, sending emails and Whatsapps...

Greater productivity

You will only have to dedicate yourself to mandatory manual tasks and clients that show more interest in contracting. This way you will save costs and your efforts will be much more effective.

New sales opportunities

Offer your clients other insurances they may need according to their circumstances, profession, age, location... And let them know about new offers that fit them.

Lower costs

Thanks to our CRM, you won't have to spend so much time serving customers and pushing sales to close sales. You will be able to dedicate yourself to other tasks or increase your client portfolio.

Why choose Nowo.tech?

Years of experience in the insurance industry have allowed us to develop an embedded technology that will help achieve the sales objectives of any business.

We have a solid digital support, capable of providing a personalized service.

Our digital solutions are adaptable to any company, regardless:

- Sector

- Business size

- Digital level

Discover our features

The options offered by our insurance CRM are limitless. Regardless of your business type and size, Nowo.tech adapts to you and helps you sell policies online quickly and conveniently.

Insurance sales system

You will have a system for automating and integrating the platform and its quotation systems anywhere. This way, you will be able to easily sell any insurance.

Platform to sell insurance

Our platform for selling insurance online is the first to digitize the entire process of distribution and sale of policies. Acquisition, sale, service, claims, collection…

Insurance software

There is currently no other insurance software that covers so many needs and is 100% adaptable.

Our functions meet the needs of end customers, intermediaries and insurers alike.

Saas for insurance

With our Saas for selling insurance you can effectively control and manage interactions with customers and intermediaries. Always in a simple and intuitive way, being able to configure the automatic notification, task and management.

Insurance sales program

Our software for selling insurance is the most complete solution on the market. You will enjoy options adapted to any technological level, business model and needs.

Embedded insurance

Our embedded insurances are configurable and adaptable to a website, application or digital support. No technological development is required on your part and, thanks to its high level of customization and configuration, no one will notice that it is a solution outside your company.

FAQs

What does embedded mean?

Our solutions are integrated into any website, application or other digital media without customers noticing that it is an external tool. In addition, it does not require any technological development on your part.

Is it for my business?

Of course. Our technology makes selling insurance easy and profitable for any business. You won’t have to commit any resources and you’ll give your customers what they really need when they need it most.

Our API will give instant quotes and allow you to take out the policy in minutes.

Nowo.tech adapts to any business, regardless:

– Type of business activity

– Size and volume of business

– Technology level

Why should I digitize the sale of policies?

Competition in this sector is tough and gaining the trust of customers can be a difficult task.

In this situation, we have found that actions such as providing them with a better experience in terms of agility, ease of communication… are very effective.

How does Nowo.tech replace an insurance CRM?

The process starts when the customer indicates the price of the policy he needs.

The data is recorded in your database, where you can control and qualify the type of user and their priority.

You will be able to manage the history of communications and interactions of the user with your messages, quotes… and manage the stage of the sale.

Once contracted, you will be able to continue accessing their information at any time, to check payment status, next renewal and much more.

You will also be able to:

– Know the origin of the subscription (if they have come to your website organically, through a campaign on social networks, through a mailing…).

– Automate notifications when the renewal is about to be completed.

– Customize email and WhatsApp templates.

– Change the stage of the sales cycle you are in.

– Monitor employee productivity

What should a good insurance software have?

– Registration of new business opportunities

– Customer information assigned to the sales opportunity

– History of users’ progress in the sales cycle

– Task management

– Block for adding notes to customers

– Segmentation

– Complaint management

– Live chat