Embedded insurance

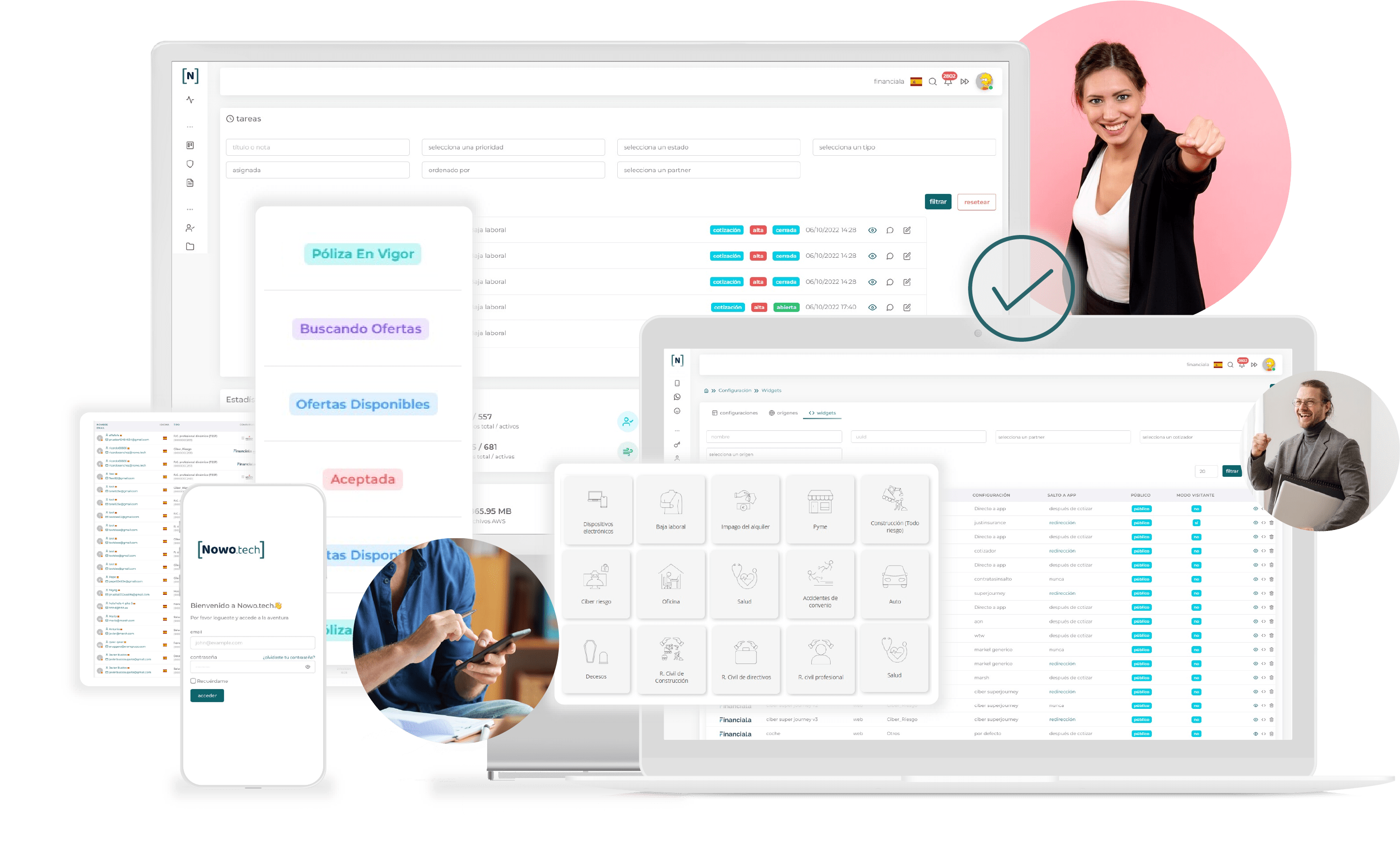

To close more B2B2C and Affinity deals

You and your partners won’t have to develop anythingㅤ

- Deploy agreements in minutes

- Customize each agreement

- Improve conversion rates

Tired of losing deals because you don't have technology?

There are more and more non-insurance brands wanting to access a market that moves more than 6 trillion euros and take advantage of the relationship with their customers and offer them the insurance they need at the key moment.

ㅤPlug & Sale Technologyㅤ

Nowo.tech develops embeddable widgets for any website, so you can distribute your products from any digital environment.

- Pricing

- Contracting

- Issuance and digital signature

Our low-code, self-service platform allows you to embed quoting and issuance solutions in any web or digital media.

Why Nowo.tech?

Advantages of our embedded insurance

We are the only embedded insurance deployment platform that makes it easy for you to develop B2B2C/Affinity opportunities without digital effort.

- Sell more and reach more customers

- Automate business processes

- Reduce sales cycles and acquisition cost

Just paste two lines of code to have your widgets integrated instantly.

Advanced lead management

With all the capabilities to manage your leads and campaigns.

Self-manageable changes in real time

Configure your widgets on your own and view the changes instantly.

Data analysis and tracking

Check your statistics and improve the conversion of your widgets.

Customized products and journeys

Customize products and flows and offer tailored experiences for each partner.

Some of our Partners

Embedded insurance ready to integrate

Contents

What is embedded insurance?

This is one of the major trends in insurance distribution. It consists of offering, during the purchase process and as an added value, a policy that makes the product or service being purchased even more complete.

With this we manage to offer the necessary protection at the right time, improving the customer experience and making it easier to purchase.

Embedded insurance features

Why should you trust Nowo.tech?

We are much more than an online insurance sales software.

Our solution is focused on the experience of both your end customers and your employees, without forgetting the partners and networks of collaborators that operate with you (ecommerces, service websites…).

In addition, we have made it possible for any of your sales processes to be carried out automatically if you wish, making it possible to scale insurance distribution.

Useful for all

Brokerage and insurance companies

End-to-end digitization

No-code

Embedded insurance

Maximum customization

Omnichannel communication

Focus on the customer

Ultra-fast start-up

Flexibility

No friction

What do we offer you?

A valid platform for any business that wants to sell insurance in a profitable and easy way.

Your employees and collaborators will be able to work efficiently and your clients will have at their disposal the insurance they want when they really need it, without depending on schedules or third parties. You will give them the option of being totally autonomous in the management of their insurance.

Our solutions are fast and 100% adaptable, regardless:

- Activity type

- Size and volume of business

- Technological level

ㅤAdvantages of using embedded insuranceㅤ

Although there are many benefits that Nowo.tech offers you and each company will give more importance to some or others, these are the most relevant for most of them:

You will be able to scale insurance sales

You won’t believe how many hours of work you will save thanks to our automations.

You will be able to increase your client portfolio without overloading your workload.

You will enjoy more profitable sales

Thanks to all these resources and time you will no longer have to spend on customer service, claims management, sending documentation… The cost of your operations will be considerably reduced.

You will adapt to market requirements

Digitalization is advancing by leaps and bounds in all sectors, and both your employees and your customers expect the same from insurance. They want to have all the information at their fingertips instantly and to do business online whenever and wherever they want.

In the case of the insurance market, even though it moves more than 6 trillion euros, its digital trend has only just begun. You could be one of the first and enjoy a much higher growth margin than you would have in a few years.

You will reinforce your brand image

How many companies do you know that already have a 100% technological solution? You will provide your end customers, employees and even networks of collaborators with a digital tool that is really useful and easy to use.

You will be able to integrate it with the tools you already work with

Thanks to our API you will be able to synchronize your data with any application, all we need is your API!

- Docusign

- Hubspot

- Zoho

Discover our features

Whatever functionality you are looking for, Nowo.tech adapts to all of them. We are much more than:

Insurance sales system

We have created an automation and embedded system with which you will be able to sell insurance effortlessly. No matter your size or technological profile, our insurance sales system adapts to all cases.

Platform for selling insurance

We are the first platform for selling insurance that has managed to digitize all insurance sales and distribution processes from start to finish. From the acquisition to the sale, including other post-sales processes such as claims management, updating information, collection queries…

Insurance software

We replace any insurance technology tool that exists in the market so far. Our functionalities satisfy both the end customer and the intermediaries and insurers. Marketing tools, synchronization with any platform, embedded quotation systems, tracking pixels…

Insurance CRM

Our CRM for insurance will allow you to manage your relationships with your customers and intermediaries in an easy way through tasks and alerts.

Program to sell insurance

We have become the most complete solution in the market, offering a program to sell insurance with options adapted to all levels and needs.

Frequently Asked Questions

What does embedded mean?

It is the characteristic of our solutions to integrate into your website, app or any digital support without your customers noticing that it is an external tool that does not require any technological development on your part.

Our technology goes beyond the traditional integrable meaning. We digitize and streamline the sale of any insurance to sell insurance.

Is it for my business?

Absolutely yes. Our technology allows any business to sell insurance profitably and easily. You will not have to allocate resources and you will offer your customers what they really need at the most relevant time.

Our API will give instant pricing and make it possible to take out the policy in less than 5 minutes.

Nowo.tech’s solutions are fast and 100% adapted to any company, no matter what:

– Type of business activity

– Size and volume of business

– Technology level

Our technology goes beyond the traditional integrable meaning. We digitize and streamline the sale of any insurance to sell insurance.

Why should I digitize the sale of policies?

Competition in this sector is tough and gaining the trust of customers can be a difficult task. In this situation, actions such as providing them with the best experience in terms of agility, ease of communication, complaint resolution… are very effective.

For this task, using Nowo.tech’s platform is the best decision. Thanks to its technology, all these tasks can be carried out without losing time or personalized treatment.

Its system allows potential customers to follow up on opportunities, automate activities and send emails and WhatsApp…

How does Nowo.tech replace insurance software?

The process will start with the customer quoting the price of the policy they need.

The data will be recorded and reflected in your administration panel, where you will be able to track and qualify the type of user involved.

Once you contract with us, we will be able to access your information at any time to check the status of payments, next renewal, among others.

The possibilities do not end here. With our development you will be able to:

– Know the origin of the registration (if they accessed your website organically, through a campaign on social networks, thanks to a mailing…).

– Automate alerts when the renewal is near.

– Customize email and WhatsApp message templates

– Change the stage of the sales cycle you are in

– Check the productivity of your employees

What should a good insurance software have?

– Registration of new business opportunities

– Customer information assigned to the business opportunity

– History of the user’s evolution in the sales cycle

– Task management

– Block to add customer notes

– Segmentation

– Claims management

– Live chats